Selling a house in New York can feel overwhelming, especially when you need to sell it quickly and avoid the usual hassles of traditional real estate transactions. That’s where We Buy Houses companies come in, offering a speedy, cash-based solution. However, it’s important to be aware that this industry is not without its risks. Scams are prevalent, and falling victim to one can leave you in a difficult situation.

Here, we help you avoid We Buy Houses scams by providing practical tips to verify legitimate cash buyers. We’ll explain how to spot red flags, check credentials, and ensure you’re dealing with trustworthy cash home buyers.

Read below to learn everything from how to recognize common scams and verify legitimate cash buyers. Additionally, you’ll also find out some of the best New York home selling tips you can use to ensure you get the best cash value for your property.

We Buy Houses companies are businesses that offer to purchase homes directly from owners, typically for cash and without the need for traditional real estate transactions. These companies provide a straightforward solution for homeowners who need to sell quickly, whether due to financial difficulties, inherited properties, or simply a desire for a fast sale.

The primary benefit of selling to a cash buyer is the speed of the transaction. Traditional home sales can take months to close, but with We Buy Houses, you can often complete the sale within a few weeks. This quick turnaround is particularly advantageous for those facing urgent situations, such as foreclosure or relocation.

Another advantage is that these companies typically buy homes in “as-is” condition. This means you don’t have to worry about making any repairs or improvements before the sale. Whether your house needs minor touch-ups or major renovations, a cash buyer will take it off your hands without requiring you to invest additional time or money.

Some companies now offer even more flexibility, allowing you to compare cash offers from multiple vetted investors or to test the waters with a short, no-obligation listing period. This approach lets you explore your options—either accepting a fast cash offer and moving on, or seeing if you can attract a higher price on the open market, all while still selling as-is and without any pressure to commit.

It’s natural to wonder if companies advertising “We Buy Houses” for cash are trying to pull a fast one. In reality, whether these companies are a rip-off depends largely on your circumstances and priorities as a homeowner.

Here’s the bottom line: cash buyers do tend to offer less than what you might get if you listed your home on the open market, especially if your property is in good condition and you have time on your side. These companies build their business around quick, hassle-free transactions, and in return for that speed and certainty, they almost always factor in a discount.

However, for many sellers, that trade-off makes sense. If your home needs major repairs, if you’re facing foreclosure, inherited a property you don’t want to manage, or just need to move quickly, a slightly lower sale price can be a fair exchange for avoiding months of showings, negotiations, and uncertainty. You’ll also skip repairs, open houses, and realtor commissions.

So are We Buy Houses companies a rip-off? Not necessarily. They’re a solution that works best for homeowners in specific situations—especially those wanting convenience and certainty over maximizing their sale price. As always, weighing your needs, comparing offers, and researching buyers carefully will ensure you get the deal that works best for you.

You might wonder why cash-for-houses companies tend to present offers noticeably lower than what you’d expect on the open market. The answer comes down to their business model and the risks they assume.

These companies specialize in buying properties quickly—often stepping in when a homeowner needs a fast sale due to foreclosure, inheritance, divorce, or extensive repairs. To make the process hassle-free for sellers, they purchase homes “as-is,” absorbing the costs and headaches of upgrades, repairs, and sometimes even legal title issues.

But these perks come with tradeoffs:

It’s not a scam if you understand the tradeoff—time and simplicity versus top dollar. For some homeowners, the reduced price is worth bypassing months of showings, negotiations, and open houses. For others, the best value is found on the open market, even if it takes longer.

You might be wondering what motivates these companies or individuals who reach out with a cash offer for your home. In most cases, We Buy Houses companies are looking for properties—especially those that may need some TLC, are inherited, or whose owners are facing financial strain—that they can purchase quickly and at a competitive price.

Their main goal? Profit through resale. Often, these buyers renovate or “flip” the property and then put it back on the market at a higher price. Sometimes, they rent the home out for steady monthly income or add it to their portfolio of investment properties. Since they’re in the business of turning a profit, their initial offers might be below what you’d expect in a traditional sale. They bank on the convenience, speed, and certainty of an all-cash deal to entice sellers who need to move fast or want to avoid costly repairs and drawn-out negotiations.

Understanding what’s driving these cash buyers helps you make informed decisions—so you don’t feel pressured into accepting an offer that doesn’t reflect your home’s true value.

While We Buy Houses companies can offer a convenient and quick solution for selling your house in New York, it’s important to be aware of and avoid We Buy Houses scams. Ultimately, you need to learn about these fraudulent tactics so you can better protect yourself and your property.

One prevalent scam involves fake cash buyers who make enticing offers but have no intention of following through. These scammers might provide a very lowball offer compared to the market value of your home, hoping you’ll accept out of desperation. Once you agree, they may ask for an upfront fee or deposit to “secure” the deal, only to disappear once they’ve received the money.

High-pressure tactics are another red flag. Scammers often create a sense of urgency, pushing you to sign contracts quickly without giving you adequate time to review the terms. They might tell you that their offer is only available for a limited time or that they are also looking at other interesting properties that may get their cash instead. This pressure is a tactic to prevent you from doing thorough research or consulting with professionals.

Finally, lack of transparency and unwillingness to provide references are major warning signs. Trustworthy cash home buyers should have no issue providing references from previous clients and being open about their business practices. If a company is evasive or refuses to share this information, it’s best to look for another buyer.

Ensuring that you’re dealing with legitimate cash buyers is crucial when selling your house in New York. Here are some effective ways to verify their authenticity and avoid scams.

The truth about scammers is that they are doing their best to appear legitimate. So, you want to do due diligence and do your homework before agreeing to any sale. Your successful home selling experience in New York begins with checking on the cash buying company. You’ve got two main avenues here:

BBB is an excellent resource for checking the legitimacy of a We Buy Houses company. BBB accreditation and ratings provide insight into a company’s reliability and customer service practices. A high BBB rating indicates a trustworthy business, while a low rating or numerous complaints can be a red flag. To check a company’s BBB profile, visit the BBB website and search for the company by name. This will allow you to see their rating, customer reviews, and any complaints lodged against them.

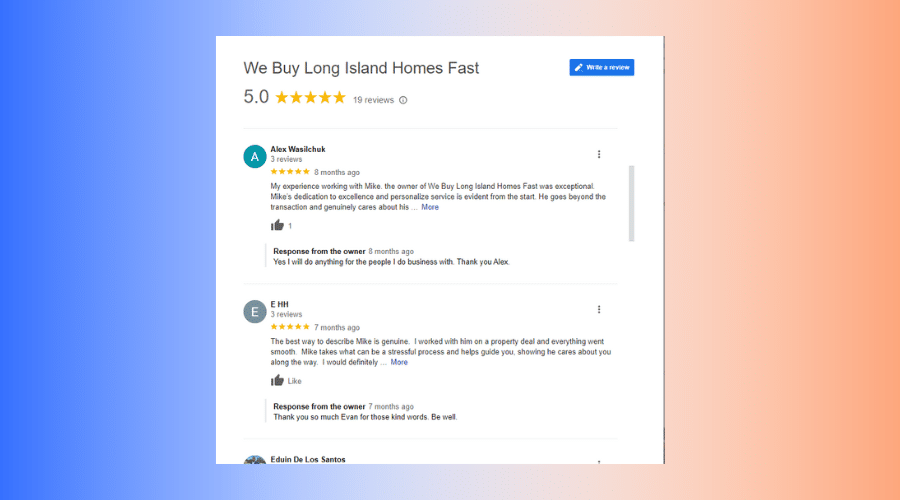

Customer reviews on platforms like Google Reviews can offer valuable information about a company’s reputation. When assessing these reviews, look for consistent patterns in the feedback. Positive reviews that mention promptness, professionalism, and transparency are good indicators of a trustworthy buyer. However, be cautious of reviews that seem too generic or overly positive, as these could be fake. Look for detailed reviews that provide specific experiences.

Platforms like Yelp and TrustPilot can provide valuable insights into a We Buy Houses company’s reputation. These sites offer customer feedback that can help you gauge the reliability and professionalism of potential cash buyers.

Proof of funds is a key safeguard when dealing with any cash buyer. Legitimate buyers should be able to demonstrate that they truly have the money available to purchase your home—otherwise, you run the risk of wasting valuable time on someone who can’t actually follow through on the sale.

Always ask to see a bank statement or an official letter from their financial institution showing the necessary funds. If a buyer won’t provide this documentation, it’s a strong indicator they may lack experience or the ability to close. Don’t hesitate to walk away if they are unwilling or unable to verify their financial backing; credible investors expect this request and provide proof as a matter of routine.

Comparing cash offers is one of the smartest moves you can make when selling your house in New York. Not only does it help you spot lowball or suspicious bids, but it also maximizes your odds of getting a fair deal. Here’s a step-by-step approach to ensure you evaluate each offer with confidence and caution:

Request Written Offers: Insist that every potential buyer provides their offer in writing. This gives you a clear basis for comparison—not just on the sale price, but on all important terms and contingencies.

Scrutinize More Than Just Price: Don’t be swayed by an eye-popping number alone. Pay close attention to closing timelines, contingencies (like inspections or financing clauses), earnest money deposit amounts, and who covers closing costs.

Verify Buyer Credentials: Ask each buyer for proof of funds and documentation of recent closings. Serious investors should have no problem sharing settlement statements or redacted purchase agreements from recent transactions.

Consult a Trusted Professional: Before agreeing to any terms, have your attorney or a licensed real estate agent review the offers and contracts. Their trained eyes can catch hidden clauses, unfavorable contingencies, or loopholes that could put your sale at risk.

Avoid Upfront Fees: Be wary if any buyer requests a fee before closing. Legitimate buyers will typically pay a refundable earnest money deposit held by a local title company or attorney.

Require Buyer Inspections Before Acceptance: Don’t accept an offer if the buyer hasn’t inspected your property. Ask them to confirm the inspection is complete and request a transparent explanation of how they calculated their offer.

Compare Side by Side: Create a simple comparison chart listing each buyer, their offer price, net proceeds after fees, timelines, contingencies, and customer reviews from sites like Google or the Better Business Bureau. This visual will make strengths and weaknesses easier to spot.

Don’t Be Pressured: Take your time—no matter how urgent the buyer seems. A reputable cash buyer will encourage you to fully understand the offer and consider your options, not rush you into a decision.

Collect Competing Bids: The more offers you collect, the more leverage you have. Bidding competition can help drive up your sale price and weed out questionable buyers.

Earnest Money Best Practices: When accepting an offer, make sure the earnest money is wired directly to an escrow account with a trusted title company or attorney, not handed over to the buyer.

By following these guidelines, you’ll not only ensure every offer gets proper scrutiny, but you’ll also put yourself in the best position to walk away with a secure and satisfying deal.

You might be wondering if selling your home on the open market will fetch a higher price than selling to a We Buy Houses company. In most cases, the answer is yes—listing your house with a real estate agent and marketing it to traditional buyers typically results in a higher sale price. Open market buyers are often willing to pay closer to fair market value, especially if your home is in good condition and you have the flexibility to wait for the right offer.

However, a cash buyer can still be the better solution if time is of the essence or your property needs significant repairs. Cash buyers make their offers based on the home’s current condition and factor in the cost and risk of renovations, which is why their offers are usually lower than what you’d get on the open market. Choosing this route might mean accepting less, but it can save you weeks (or even months) of showings, negotiations, repairs, and waiting for financing approvals.

Ultimately, if maximizing your sale price is your top priority and your home is in market-ready shape, listing with a trusted real estate agent in New York is likely your best bet. But if speed, convenience, and avoiding repairs are most important, selling to a reputable cash buyer could be the right move.

When it comes to selling your house for cash in New York, not all buyers are created equal. Understanding the different types of cash buyers can help you decide which route best fits your needs and circumstances.

iBuyers (like Opendoor and Offerpad) are large, tech-driven companies that use data algorithms to make fast, competitive offers—typically within 24–48 hours. They prefer purchasing newer or well-maintained homes in specific markets, and can often close in as little as 10 days. If your home is in good condition and you’re looking for convenience without major repairs or showings, an iBuyer could be an option. However, keep in mind that iBuyers have strict buying criteria and may not be available in all New York neighborhoods.

Local cash investors or house flippers are individuals or small companies who specialize in buying properties that need repairs or quick sales. They aren’t picky about condition—whether your house needs minor updates or a full gut renovation, a cash investor is likely interested. The tradeoff? These buyers tend to pay below market value (often 60–80% of what your home might fetch on the open market), but they offer fast transactions with no strings attached.

For those who want to see multiple offers or vet buyers more thoroughly, cash offer marketplaces are an emerging option. These platforms connect sellers with a pool of pre-screened cash buyers, allowing you to compare different offers side-by-side. While this method helps avoid scams and boosts your negotiating power, not all marketplaces serve every location—be sure to check availability in your area.

If you’d rather not sell to a “We Buy Houses” company but still want to avoid the hassle of repairs, listing your home “as is” with a licensed real estate agent can be another path. In this scenario, your agent will market the property’s current condition upfront. As-is listings often attract investors or buyers seeking a fixer-upper, but you might net a higher sale price than selling directly to a cash company—especially if there’s competition among buyers.

Each of these buyer types has its pros and cons, depending on your timeline, the home’s condition, and your financial goals as a seller. Understanding these differences will empower you to choose the cash buyer that matches your unique situation.

While working with a We Buy Houses company delivers speed and convenience, there are several trade-offs to keep in mind before you agree to a cash offer.

Lower Sale Price:

Perhaps the biggest drawback is the reduced price you’ll receive. Cash buyers and investors generally won’t pay full market value for your property, especially if your home requires repairs or updates. They often structure offers around 70% of what they believe your home will be worth after renovations, minus estimated repair costs. For example, if your home could sell for $300,000 after $50,000 in repairs, you might only get an offer of around $160,000. This means you’re leaving a significant amount of money on the table compared to a traditional sale.

Less Negotiation Power:

Since these companies are purchasing homes as investments, they often have set buying formulas and may not be as flexible on price or terms. You might find there’s little room for negotiation, and if the market value of your home is high, selling to a cash buyer could cost you tens of thousands of dollars.

Fewer Protections:

Traditional buyers typically come with contingencies, inspections, and legal safeguards that protect both parties. Working with a direct cash buyer may mean fewer disclosures and protections—so you need to be even more diligent about reading and understanding every part of your contract.

Quick Sales Can Mean Quick Decisions:

The expedited timeline can be a double-edged sword. On one hand, you avoid months of uncertainty; on the other, you may feel pressure to make a decision before you’re fully informed. Rushing could lead to overlooking key details or missing better offers elsewhere.

How to Minimize the Risk:

To avoid seller’s remorse or falling victim to a lowball offer, consider the following:

By understanding these disadvantages, you’ll be better prepared to make an informed choice that fits your timeline, needs, and financial goals.

Spotting fake reviews can be tricky, but there are some telltale signs. Reviews that are overly enthusiastic, lack detail, or use similar language can indicate they were written by the same person or generated by bots. Also, check the dates of the reviews; a sudden influx of positive reviews within a short time frame can be suspicious. Cross-referencing reviews on multiple platforms like Yelp can also help ensure their authenticity.

When selling your house in New York, verifying that a We Buy Houses company has the appropriate and active real estate licenses and certifications is crucial. You can verify a New York Real estate license here. Most real estate professionals are licensed by name rather than by organization.

Licensed companies are generally more reliable and professional, as they must comply with industry standards and legal requirements. A licensed business is also more accountable, providing you with a layer of protection if any issues arise during the transaction. In New York, real estate companies and agents must be licensed by the New York Department of State.

Verifying a company’s licensing status is straightforward and can be done through various online resources. The New York Department of State’s website provides a searchable database where you can look up real estate licenses for professionals. Simply enter the company’s name or the individual’s name to check their license status and ensure it is active and in good standing.

Membership in local real estate boards and associations can also be a good indicator of a company’s legitimacy. These organizations often require members to adhere to a code of ethics and maintain professional standards. You can check if a company is a member of associations like the New York State Association of Realtors (NYSAR) or local boards by visiting their respective websites.

Beyond basic licensing, look for additional certifications and professional designations that indicate expertise and commitment to ethical practices. Certifications from recognized organizations, such as the National Association of Realtors (NAR), can be a positive sign. These certifications often require continuing education and adherence to higher standards of practice.

A professional and transparent online presence is another crucial factor in verifying the legitimacy of a We Buy Houses company when selling your house in New York. Here’s what to look for when assessing a company’s website and online presence.

A legitimate company will have a well-designed, user-friendly website that clearly outlines their services, process, and contact information. Look for detailed information about the company’s history, mission, and team members. Professional websites often include client testimonials, case studies, and examples of previous transactions.

Ensure the website provides a physical address and multiple ways to contact the company, such as phone numbers and email addresses. A legitimate business should have a verifiable physical location, even if they primarily operate online. You can use tools like Google Maps to confirm the address and check if it corresponds to an actual business location.

When selling your house in New York, it’s essential to verify legitimate cash buyers thoroughly. Asking the right questions can help you ensure you’re dealing with experienced and trustworthy cash home buyers.

How long have you been in business? Experience is a critical factor in determining the reliability of a cash buyer. Companies that have been in business for several years are more likely to have a solid track record and a history of successful transactions. Ask how many years they’ve been operating and how many homes they’ve purchased to gauge their experience level.

Can you provide references from previous clients? A reputable cash home buyer should have no problem providing references from previous clients. Speaking with past clients can give you valuable insights into their experiences and the company’s reliability. Look for detailed feedback on how smoothly the process went and the overall satisfaction of the clients.

What is your process for making an offer and closing the deal? Understanding the buyer’s process is crucial. Ask them to explain step-by-step how they determine their offer, what factors they consider, and how long it typically takes to close the deal. Legitimate buyers should be transparent about their process and provide a clear timeline.

It’s also worth asking about the math behind their offers. Many cash buyers—especially those in the “we buy houses” business—will cap their offer at around 70% of the property’s after-repair value (ARV), subtracting estimated repair costs and other expenses. For example, if your home could be worth $300,000 after $50,000 in repairs, you could expect an investor to offer somewhere in the ballpark of $160,000. This approach allows them to cover their costs and still make a profit when reselling or renting out the property.

By getting clarity on their evaluation process and the numbers they use, you’ll be better prepared for the kind of offer you might receive—and can decide if it fits your needs or if you’d prefer to explore other selling options.

Are there any fees or commissions involved? One of the advantages of selling to a cash buyer is avoiding realtor fees and commissions. However, some companies might have hidden fees that could reduce your net proceeds. Ensure you get a clear understanding of any potential costs involved and confirm that there are no hidden charges.

Before signing any cash offer contract, it’s wise to have a real estate attorney or CPA carefully review the terms on your behalf. Professionals are trained to spot hidden pitfalls—such as lengthy inspection periods, vague contingencies, or unusually low earnest money deposits—that could leave you at a disadvantage if the deal falls through unexpectedly.

Not only can an experienced eye identify clauses that might undermine your interests or jeopardize your proceeds, but they’ll also ensure you aren’t agreeing to terms that benefit the buyer at your expense. Reputable buyers will always give you the time needed to conduct this type of due diligence, rather than pushing for a rushed signature. Taking this step can save you from financial headaches and future disputes down the line.

When selling your house in New York, being aware of potential red flags can help you avoid We Buy Houses scams.

Unsolicited Offers and Pressure to Sign Quickly One major red flag is receiving unsolicited offers, especially if the buyer pressures you to sign a contract quickly. Scammers often create a false sense of urgency, pushing you to make hasty decisions without thoroughly reviewing the terms. A legitimate cash buyer will give you the necessary time to consider the offer.

Offers That Seem Too Good to Be True If an offer seems significantly higher than other offers or too good to be true, it likely is. Scammers may use inflated offers to entice you, only to reduce the price later with hidden fees or unexpected conditions.

Lack of Written Contracts and Clear Terms A trustworthy cash home buyer will provide a clear, written contract that outlines all terms and conditions of the sale. Be wary of buyers who are reluctant to provide written agreements or present vague contracts. Ensure the contract includes the sale price, any fees, the closing date, and other crucial details.

When reviewing a cash offer agreement, pay close attention to the contingencies included in the contract. Not all contingencies are created equal—some protect both parties, while others can leave you at risk if you’re not careful.

Here’s what to look for and approach with caution:

Vague Cancellation Clauses

If the contract allows the buyer to walk away “for any reason,” or includes broad language giving them the right to cancel at any time, consider it a warning sign. An experienced cash buyer should only include clearly defined contingencies, such as those related to title or legitimate inspection findings.

Extended Closing Timelines

A genuine cash buyer should be able to close quickly—typically within one to three weeks. If the agreement sets a much later closing date without a clear reason, it could mean the buyer is not actually prepared with funds or intends to assign (wholesale) your contract to another party.

Clauses Allowing Relisting

Beware of any clause that lets the buyer put your home back on the market—or “relist”—while you’re under contract. This is often a sign that the buyer doesn’t intend to complete the purchase unless they secure a backup buyer at a higher price.

If you notice any of these terms, question the buyer about them directly. A reputable investor will be transparent about their intentions and should be willing to adjust the contract to address your concerns. When in doubt, it never hurts to have a licensed real estate attorney review the agreement before you sign.

A legitimate cash buyer should be prepared to offer an earnest money deposit as a show of good faith when going under contract. In New York, it’s common for earnest money deposits to range from 1% to 2% of the agreed-upon purchase price. For example, on a $100,000 property, this would typically mean a deposit between $1,000 and $2,000.

Serious buyers are willing to put down this amount, as it demonstrates their commitment to moving forward with the purchase. If a buyer is hesitant to provide a reasonable earnest money deposit or tries to offer a much lower amount, it may be a sign they’re not fully invested in closing the deal—or worse, that they may not be a legitimate buyer.

While a cash offer from a We Buy Houses company can be a lifesaver for many homeowners, it’s not always the ideal route for everyone. Here are a few scenarios where you might want to consider other selling options:

Your home is in good condition: If your property requires minimal repairs or none at all, listing it traditionally might fetch you a significantly higher price on the open market.

You’re in a thriving seller’s market: When demand is high and inventory is low—like in many New York neighborhoods—homes often sell quickly for top dollar without needing a cash buyer.

You have time and flexibility: If you aren’t rushed and can wait for the right buyer, going through a real estate agent could allow you to maximize your profits, even if the house needs a little work.

You’re prepared for the selling process: If taking care of minor repairs, staging, and showings isn’t overwhelming for you, leveraging the open market can lead to more competitive offers.

Ultimately, while cash buyers offer speed and convenience, they’re generally best suited for those who need to sell fast or have properties that don’t show well in traditional listings. For sellers with time, patience, and a market-ready home, conventional selling methods may be a better fit.

In conclusion, selling your house in NY for cash can be convenient as long as you know how to avoid We Buy Houses scams. You want to verify legitimate cash buyers through the BBB, Google Reviews, and other review platforms like Yelp and TrustPilot. Always check for proper real estate licenses and scrutinize the company’s online presence. Doing your due diligence by asking important questions about their business history, references, and process details can save you a lot of hassles. The bottom line, you want to keep your eyes peeled for red flags.

For more New York home selling tips or if you’re ready to sell your home to a cash buyer now, don’t hesitate to reach out to our team at We Buy Long Island Homes Fast. We have a proven track record of professionalism and customer satisfaction, and we’re here to answer all your questions.

Please submit your property information below now to receive a fair all cash offer.

Trusted By Long Island Home Sellers